Run Uppers

General Information

The Run Uppers trigger detects trader accounts with a "Low Start" strategy, where traders consistently generate profitable trades in recent transactions. This may indicate exploitation of dealing desk vulnerabilities.

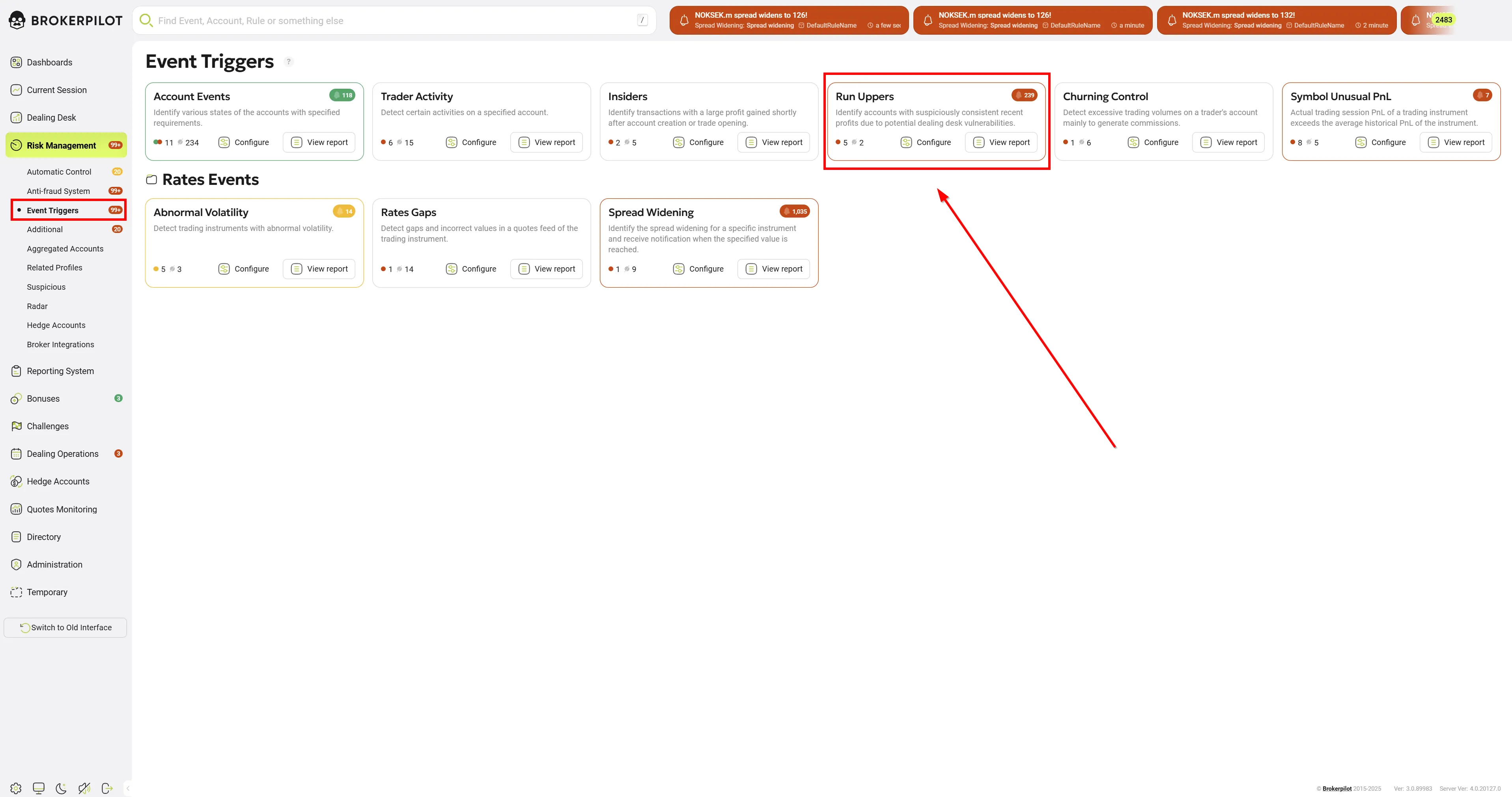

Menu Navigation

📌 You can find the Run Uppers trigger under:

Risk Management → Event Triggers

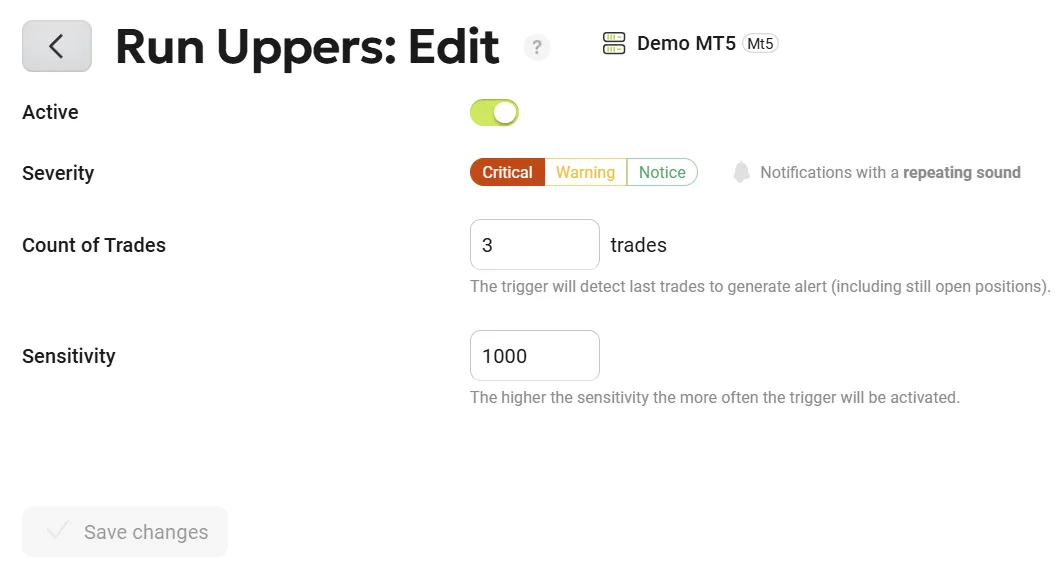

Edit Settings

| Parameter Name | Description |

|---|---|

| Count of Trades | The number of most recent trades (including open orders) analyzed for profitability patterns. |

| Sensitivity | A notional value that defines the ratio of profitable trades to unprofitable trades. |

Permissions

| MT4 | MT5 |

|---|---|

| No specific permissions required. | No specific permissions required. |

Trigger Logic

The Run Uppers trigger is designed to detect periods of abnormal profitability by analyzing the ratio of gains to losses within a specific window of trades. Unlike simple PnL tracking, this trigger uses logarithmic scaling to normalize the impact of outlier trades.

Calculation Algorithm

The trigger performs the following steps to evaluate account activity:

-

Trade Selection: The system retrieves the $N$ most recent trades (defined by the Count of Trades setting) based on their Open Time.

-

Logarithmic Summation: The system calculates the natural logarithm (ln) of the absolute value of the profit/loss for each trade. These are summed into two separate variables:

profitLn: The sum of ln(|Profit|) for all profitable trades in the sample.lossLn: The sum of ln(|Loss|) for all losing trades in the sample.

-

Ratio Calculation: The system determines the performance ratio:

ratio = profitLn / lossLn -

Comparison: The calculated

ratiois compared against the Sensitivity parameter. If the ratio meets or exceeds the Sensitivity, an alert is triggered.

Calculation Example

Settings:

- Count of Trades: 5

- Sensitivity: 2.0

Sample Data (Last 5 trades):

| Trade # | Profit/Loss (USD) | Absolute Value | ln(|x|) | Category |

|---|---|---|---|---|

| 1 | +$150 | 150 | 5.01 | profitLn |

| 2 | +$200 | 200 | 5.30 | profitLn |

| 3 | -$30 | 30 | 3.40 | lossLn |

| 4 | +$100 | 100 | 4.61 | profitLn |

| 5 | -$15 | 15 | 2.71 | lossLn |

Results:

- Total

profitLn: 5.01 + 5.30 + 4.61 = 14.92 - Total

lossLn: 3.40 + 2.71 = 6.11 - Final Ratio: 14.92 / 6.11 = 2.44

Outcome: Since 2.44 > 2.0 (Sensitivity), the trigger will ACTIVATE.

Technical Notes for Users

- Sensitivity: The higher the sensitivity, the more "aggressive" the winning streak must be to trigger the alert.

- Absolute Values: Using absolute values for logarithms ensures that the ratio compares the magnitude of wins versus the magnitude of losses.