Churning Control

General Information

This trigger is designed to identify churning, a practice where excessive trading volumes are generated on a trader's account primarily to produce commissions, rather than to meet investment objectives. This activity typically does not result in a significant PnL (Profit and Loss) change.

Once an account is detected frequently buying and selling large volumes with minimal impact on the trader's investment performance, the trigger generates a notification.

Menu Navigation

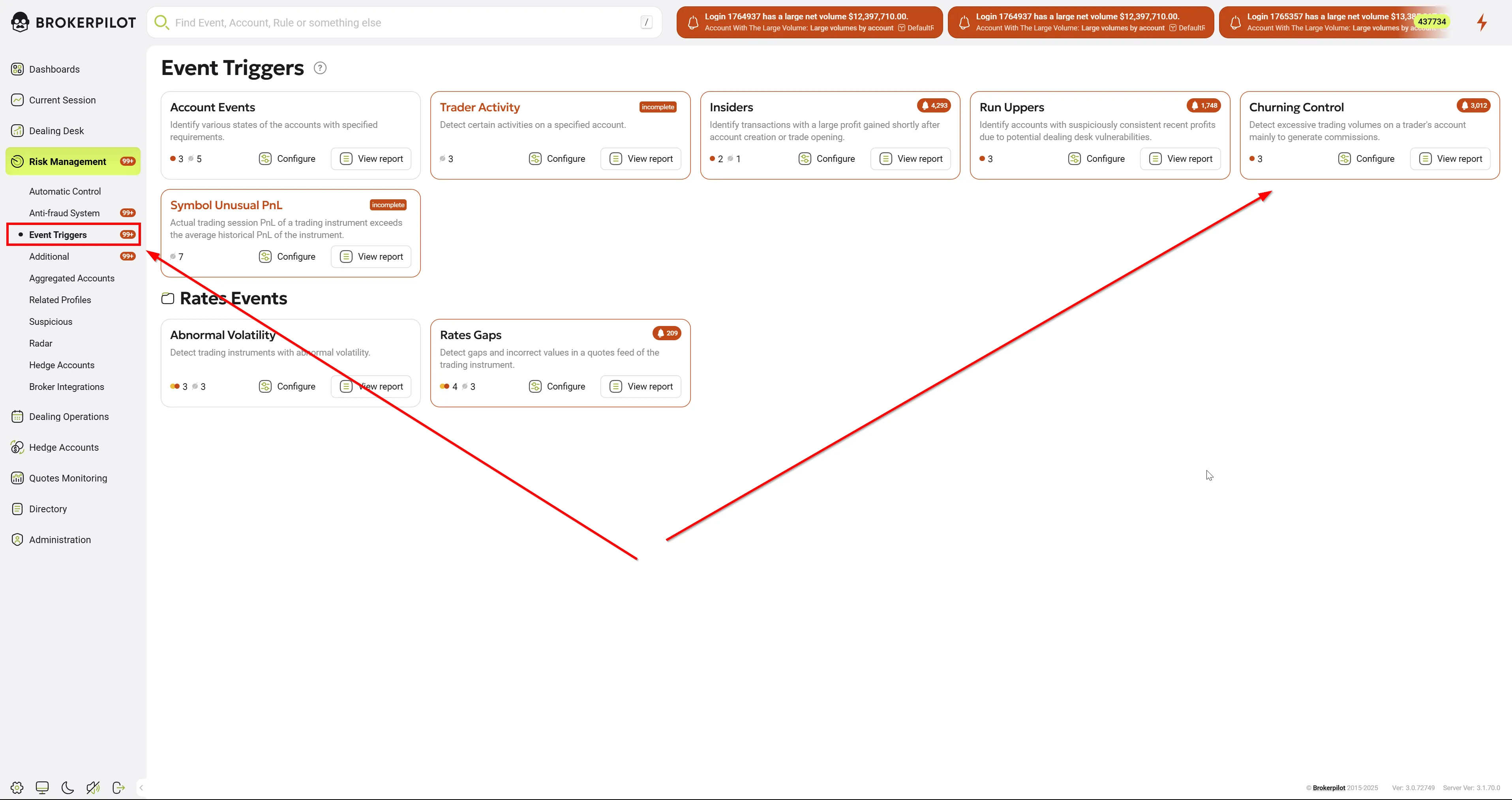

You can find the Churning Control trigger under:

Risk Management → Event Triggers

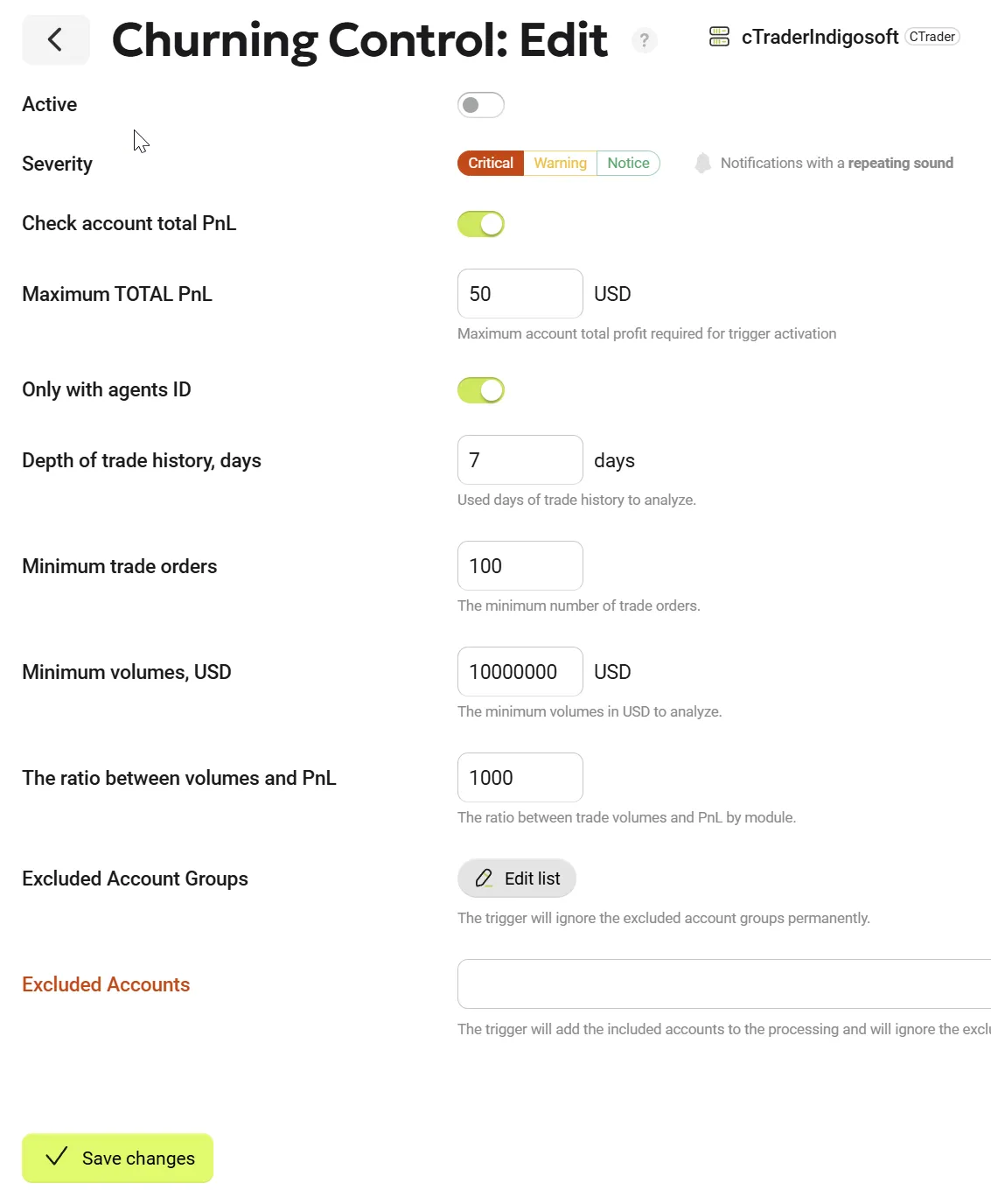

Edit Settings

| Parameter Name | Description |

|---|---|

| Only with agent IDs | The trigger will ignore accounts without an agent ID. |

| Check account total PnL | A switch that activates Maximum TOTAL PnL setting. |

| Maximum TOTAL PnL | Maximum account total profit required for trigger activation. |

| Depth of trade history, days | The time period (in days) of an account's trade history that will be analyzed by the trigger. |

| Minimum trade orders | The minimum number of orders placed over the specified time period required for further account analysis. |

| Minimum volume, USD | The minimum total trading volume in USD required for an account to be analyzed. |

| Ratio between volume and PnL | The ratio of the account's total trading volume (USD) to the account's PnL (USD) during the current trading session. If the ratio exceeds the specified value, a notification will be generated. |

| Excluded Account Groups | Account groups that are excluded from monitoring. |

| Excluded Accounts | Specific accounts that are excluded from monitoring. |

Permissions

| MT4 | MT5 |

|---|---|

| No specific permissions required. | No specific permissions required. |

Trigger Logic

The trigger operates based on one parameter and three thresholds that need to be configured:

1. Depth of Analysis

- The depth of account trading history to be analyzed, measured in days.

2. Three Thresholds for Analysis

- Minimum number of orders placed over the specified time period.

- Minimum total volume of these orders in USD.

- Ratio of PnL to total volume (if this ratio exceeds the specified value, a notification is generated).

Process Workflow:

- If the account does not meet one of the first two thresholds (minimum orders or minimum volume), the analysis stops.

- If the account meets both threshold values, the trigger calculates PnL from the orders placed during the period and compares it to the total trading volume (USD).

- If the PnL-to-volume ratio exceeds the third threshold, a notification is generated.