Abnormal Volatility

General Information

The Abnormal Volatility trigger detects real-time volatility spikes in trading instruments and alerts the broker accordingly. It identifies sudden price deviations by comparing short-term (1-minute) vs. long-term (60-minute) volatility.

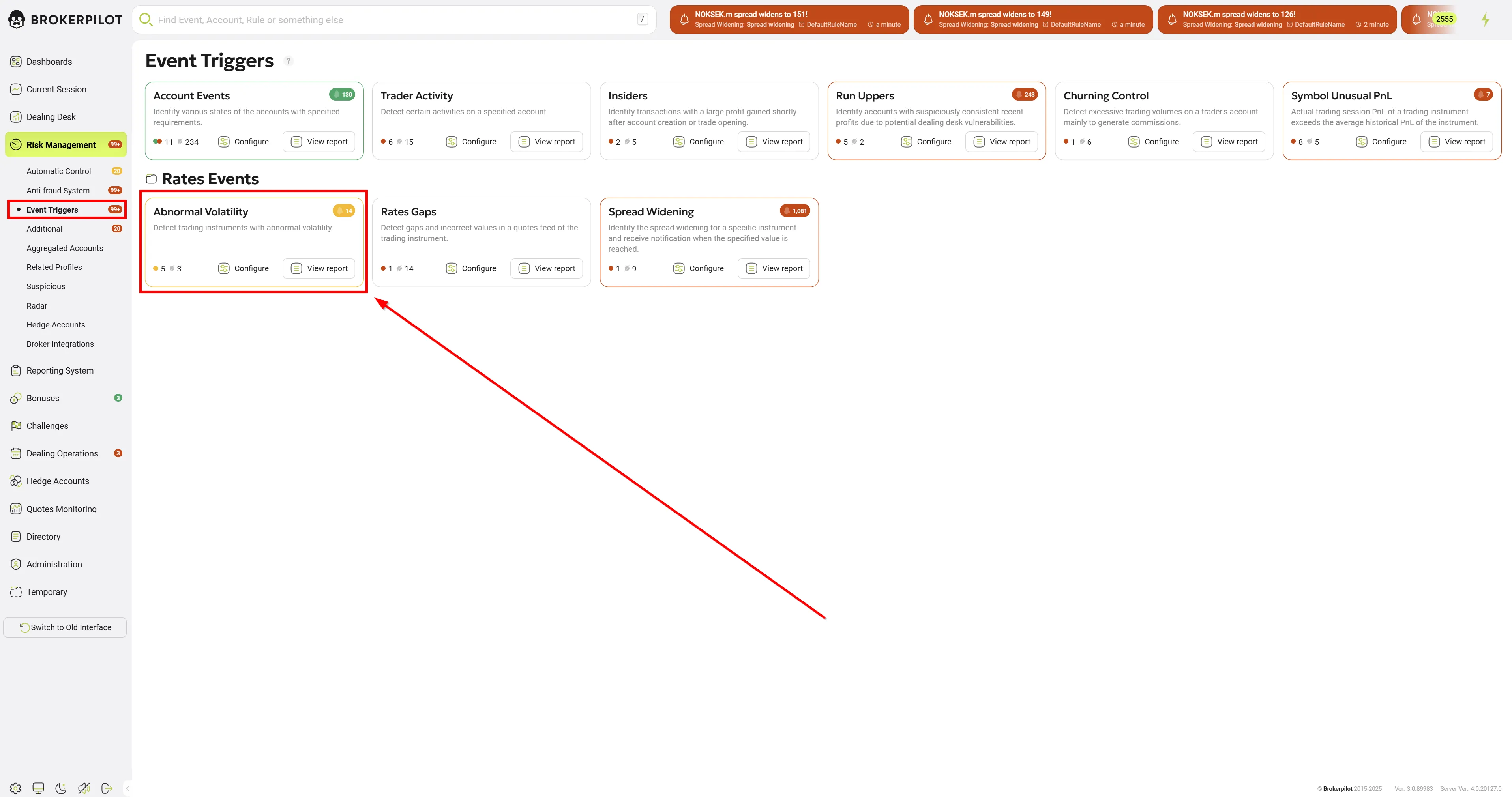

Menu Navigation

📌 You can find the Abnormal Volatility trigger under:

Risk Management → Event Triggers

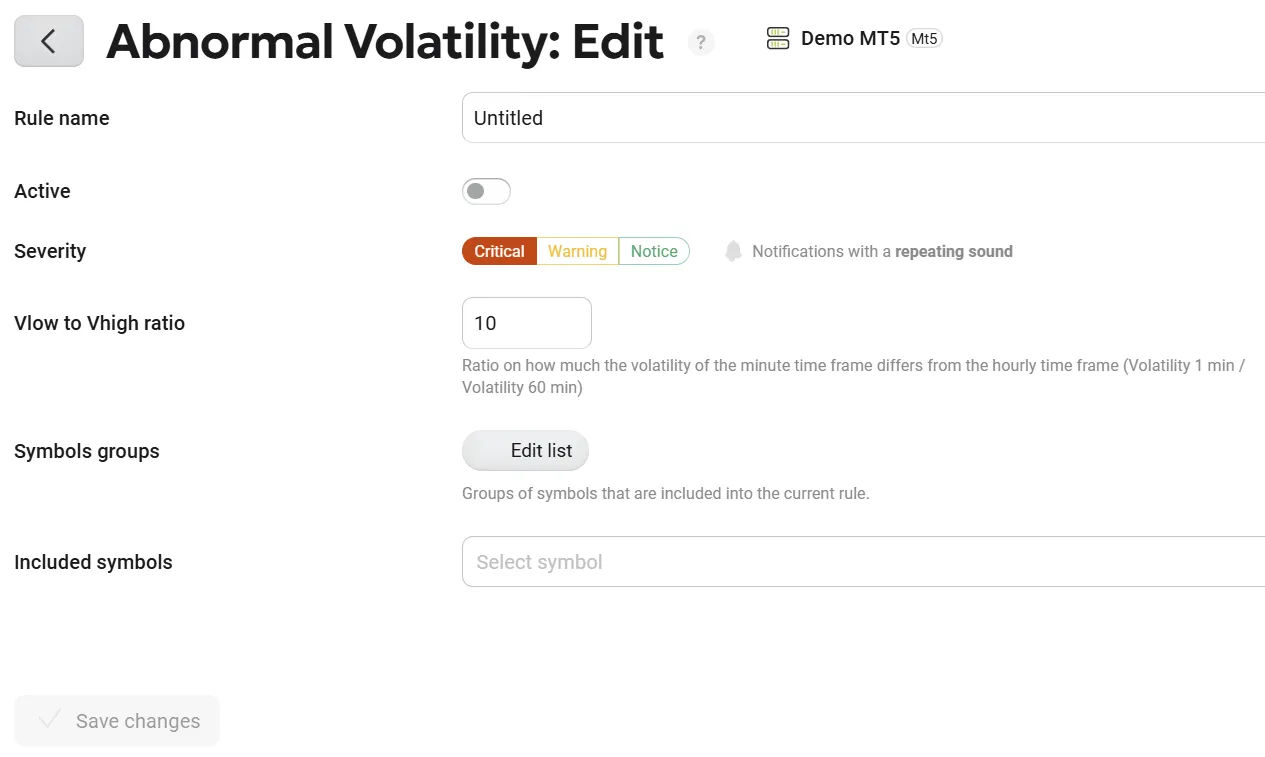

Edit Settings

| Parameter Name | Description |

|---|---|

| Rule Name | Assign a custom name to the rule. |

| Vhigh to Vlow Ratio | Defines the volatility threshold as the ratio of 1-minute standard deviation (Vlo) to 60-minute standard deviation (Vhi). Default setting: 10. |

| Symbol Groups | Select groups of symbols to monitor. |

| Included Symbols | Specify individual symbols for monitoring. |

Notifications

When triggered, the notification includes a TradingView chart of the affected symbol.

📌 Important: If the notification is not processed in real-time, the volatility spike may no longer be visible on the chart.

Permissions

| MT4 | MT5 |

|---|---|

| No specific permissions required. | No specific permissions required. |

Trigger Logic

- The trigger calculates volatility using historical price data:

- Vhi = Standard deviation of 60-minute timeframe.

- Vlo = Standard deviation of 1-minute timeframe.

- It compares the ratio of short-term to long-term volatility (Vlo / Vhi).

- If the ratio exceeds the threshold (e.g., >2), the system generates a notification.

The standard deviation Vhi is calculated based on hourly candles (closing prices) over the last 31 days (i.e., one month). As a result, by definition, this value is quite stable and changes slowly.

For calculating the standard deviation on minute candles Vlo, the last 100 one-minute candles are used.

The trigger is activated if the ratio Vlo / Vhi >= Threshold (where the threshold is configured in the rule for the symbol).

This means the numerator can change quite quickly compared to the denominator. However, the denominator also changes over time, which means the trigger threshold may need to be adjusted from time to time because the market evolves.

If the trigger settings are not adjusted accordingly, and the current market remains relatively stable, the system may generate periodic notifications (once per hour — this interval is implemented to avoid constant second-by-second triggering). This behavior is actually an indication that the trigger needs reconfiguration.

In summary: the Abnormal Volatility trigger uses market parameters measured at significantly different time scales. While this makes the activation threshold relatively stable, it may still degrade over time as the market changes. As a result, the trigger might need to be recalibrated occasionally for specific symbols — for example, if the market has changed to the point where the old coefficient is always triggering (or no longer triggers at all).