Latency Arbitrage

General Information

The Latency Arbitrage trigger detects and alerts brokers about profitable trades executed during price feed gaps (missing quotes in the trading platform).

📌 Purpose: Identifies traders exploiting delayed market data for unfair advantages.

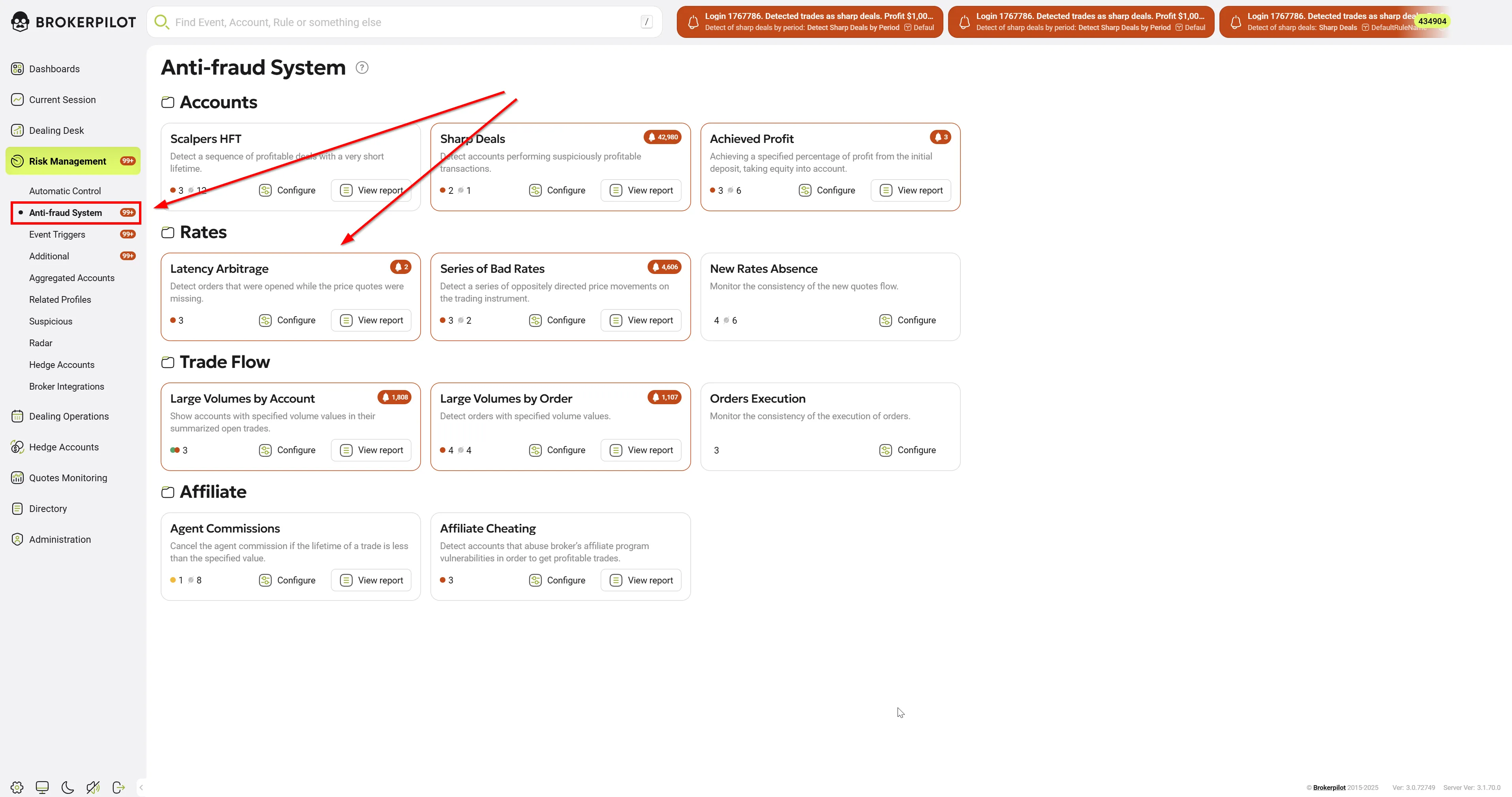

Menu Navigation

📌 Risk Management → Anti-Fraud System

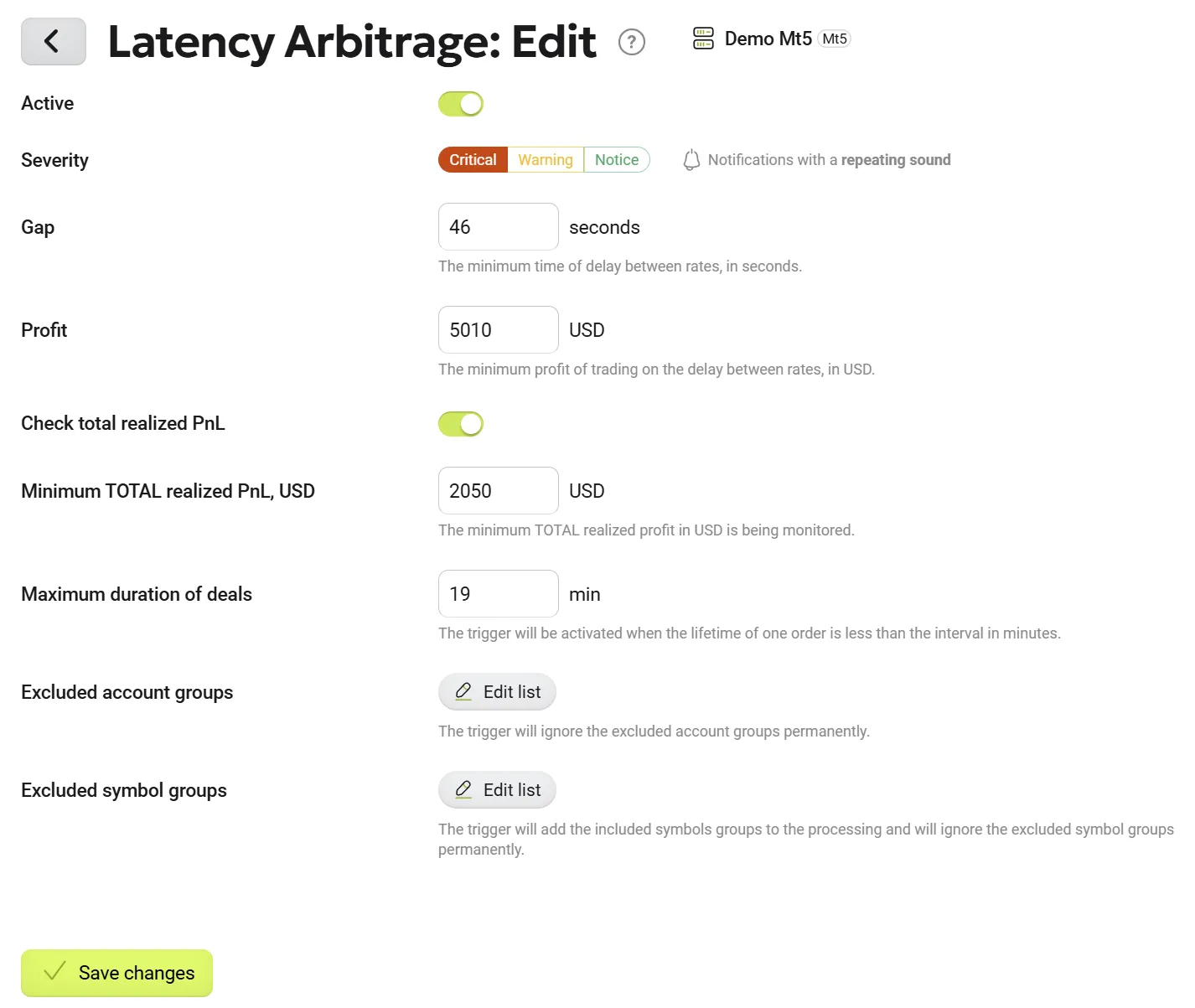

Edit Settings ⚙️

Available Settings

| Parameter Name | Description |

|---|---|

| Gap, Seconds | Defines the minimum time between ticks that qualifies as a price gap. |

| Profit, USD | The minimum profit required for a trade to be considered in the trigger. |

| Check Total Realized PnL | Enables/disables total realized profit monitoring. |

| Minimum Total Realized PnL, USD | The minimum total profit required for the trigger to react. |

| Maximum Duration of Deals, Minutes | The maximum trade lifetime to be considered as latency arbitrage. |

| Excluded Account Groups | List of account groups excluded from monitoring. |

| Excluded Symbol Groups | List of trading symbols excluded from monitoring. |

Permissions

| MT4 | MT5 |

|---|---|

| No specific permissions are required. | No specific permissions are required. |

Trigger Logic 🔍

How It Works:

1️⃣ The trigger monitors price feed gaps where no quotes were available for an extended time.

2️⃣ If a trade is opened during a gap period, it is flagged for monitoring.

3️⃣ If the trade is closed within the time limit set by Maximum Duration of Deals, it is further analyzed.

4️⃣ If the profit exceeds the Profit in USD threshold, a notification is generated.

5️⃣ If a trade remains open longer than the threshold, it is removed from monitoring (not considered latency arbitrage).

🎯 Key Takeaways:

✅ Detects traders exploiting price feed gaps.

✅ Customizable profit & duration thresholds.

✅ Filters out long-term trades to prevent false alerts.

✅ Essential anti-fraud tool for brokers.