Change Spread by Period

General Information

The Change Spread by Period trigger directly manages the spread size of a trading symbol according to a weekly schedule set in the trigger settings. This helps brokers prevent arbitrage cheating caused by differences between the fixed spread and the floating spread across trading sessions. This trigger is particularly useful for widening the fixed spread when necessary.

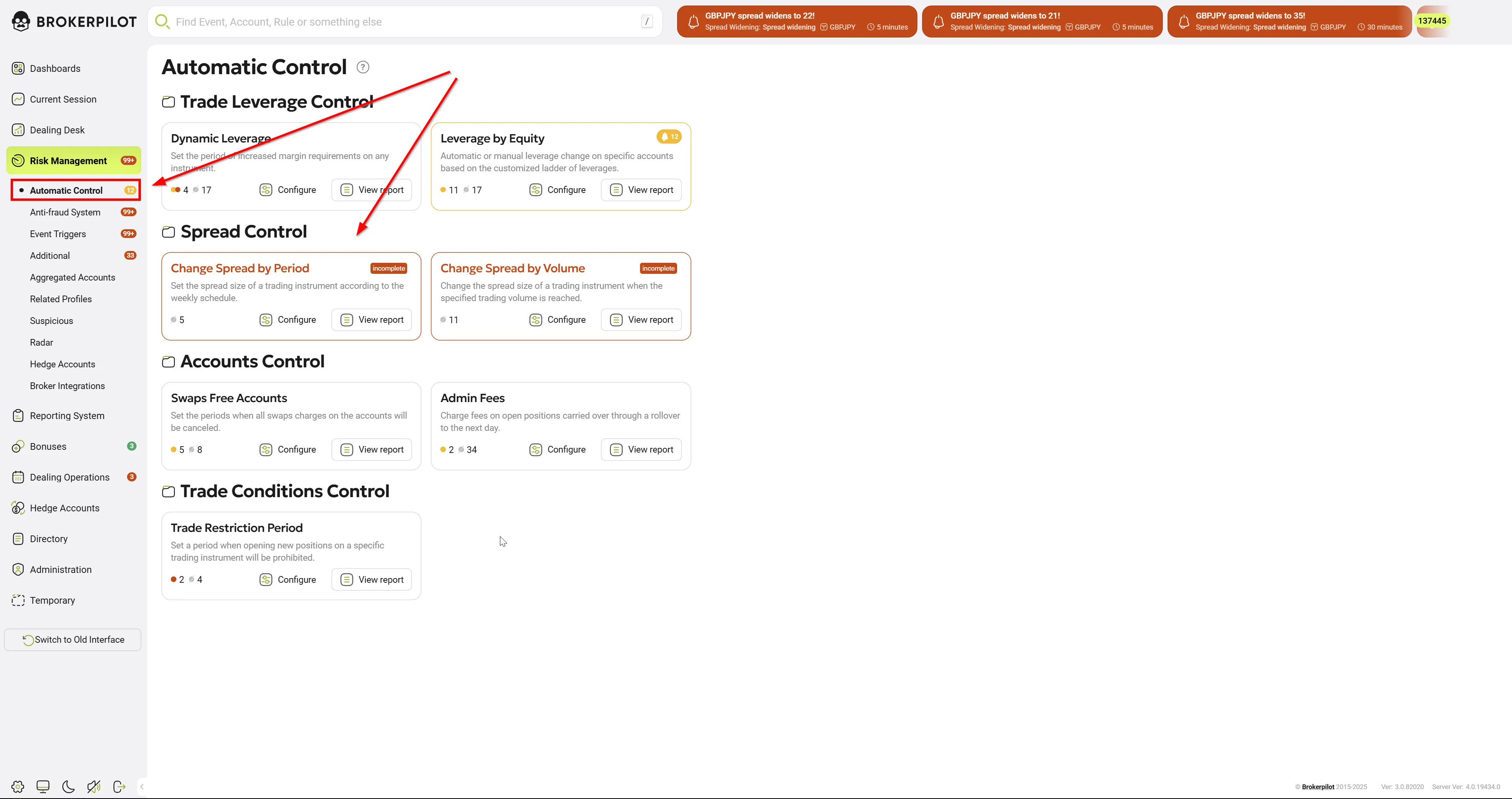

Menu Navigation

You can find the Change Spread by Period trigger under:

📌 Risk Management → Automatic Control

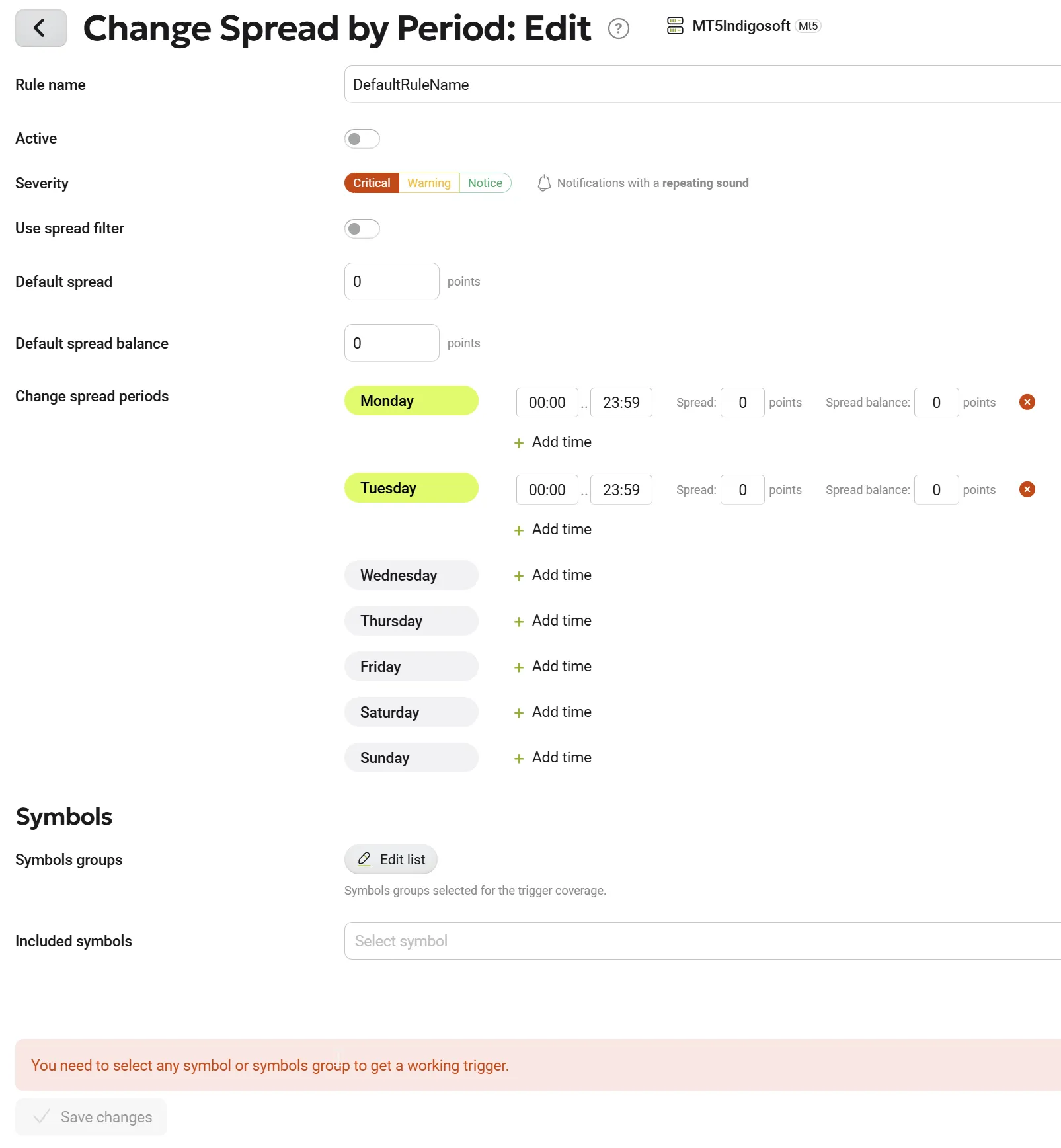

Edit Settings

Parameters & Descriptions

| Parameter Name | Description |

|---|---|

| Enabled/Disabled | Enables or disables a specific setting for a particular trading symbol. |

| Use Spread Filter | Enables or disables a spread filter with Max and Min values (supported only on MT5). |

| Remove Symbol | Removes a particular setting for a specific trading symbol. |

| Default Spread (points) | The default spread size of the selected trading symbol. |

| Default Spread Balance (points) | Defines how the default spread size should be balanced. Supported by both MT4 & MT5. |

| Spread (points) | A new spread size applied to the selected symbol within a specified time period. |

| Spread Balance | The balance of the new spread size applied to the selected symbol within a specified time period. |

| Default Spread Min (points) | If “Use Spread Filter” is ON, this sets the minimum spread value (MT5 only). |

| Default Spread Max (points) | If “Use Spread Filter” is ON, this sets the maximum spread value (MT5 only). |

| Time | The time period during which the trigger applies the new spread size. |

| Symbol Groups | Specify groups of trading instruments to monitor. |

| Included Symbols | Select specific trading symbols for monitoring. |

Setting Up a New Spread Size

The new spread size can be set in two ways:

✔ With the “Spread Filter”

✔ Without the “Spread Filter”

Steps to Configure the New Spread Size

-

Define Default Spread Values

- For a selected symbol, specify the Default Spread and Default Spread Balance.

- These values will be applied outside of the scheduled periods.

- Both values must be specified in points.

- If the Spread Balance is set to 0, the spread points will be equally distributed for long and short positions.

-

Set the Time Period

- Choose a weekday and set the start and end time when the new spread size should be applied.

-

Specify the New Spread Values

- Enter the new spread size in the Spread field (in points).

- Define the Spread Balance, which determines how the spread is allocated.

-

(Optional) Enable Spread Filter (MT5 Only)

- If the “Use Spread Filter” switch is ON, the new spread size and spread balance will be applied alongside the spread filter.

- Set Spread Min and Spread Max values.

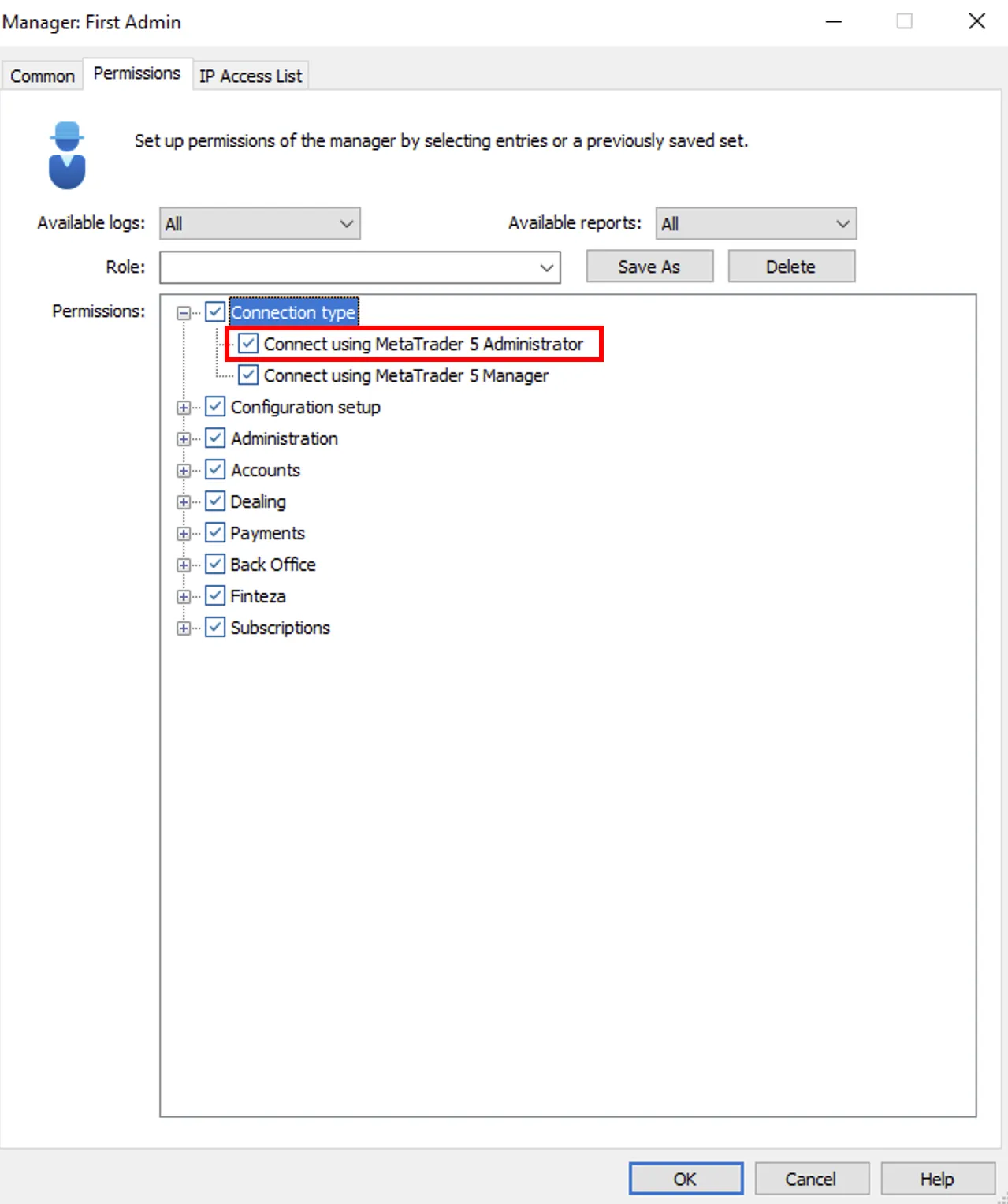

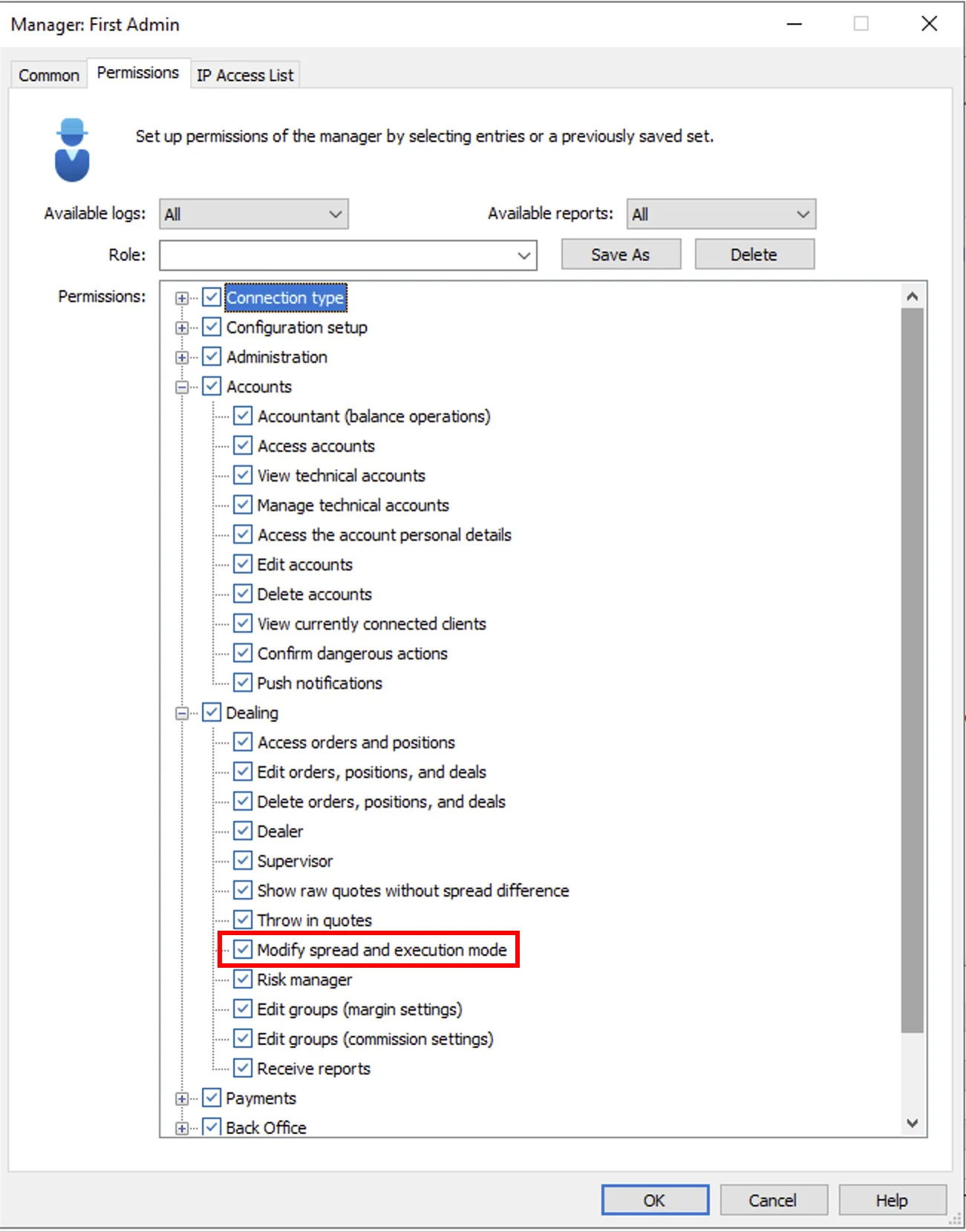

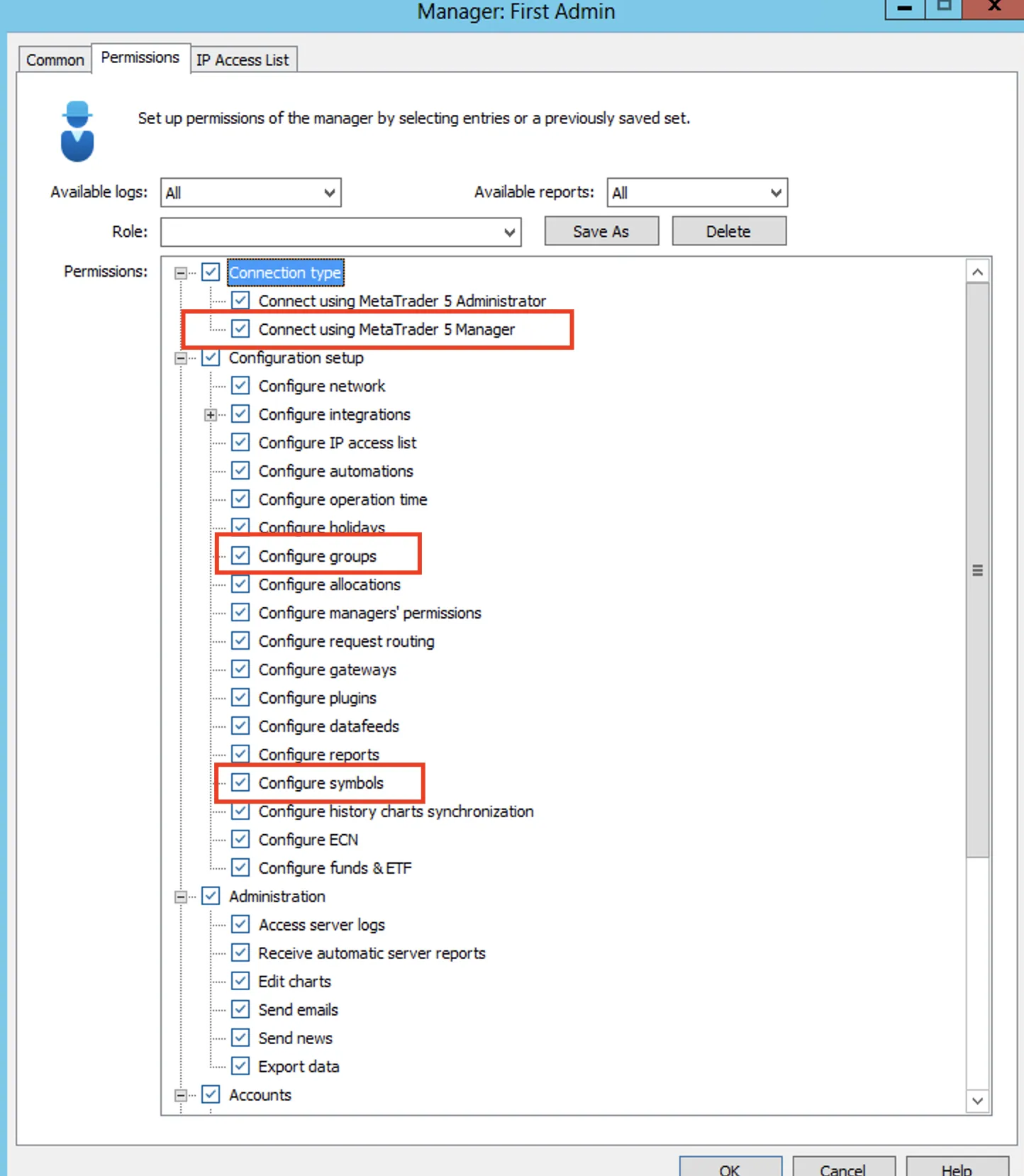

Permissions

| MT4 | MT5 |

|---|---|

| Not applicable |  |

| |

|

Trigger Logic

The trigger manages spread size by applying a specific spread value to a selected trading symbol during predefined time periods.

📌 Note:

The Spread Filter feature is only supported on the MT5 platform.

Key Use Cases

Fixed spread accounts are a popular choice among traders who prefer a guaranteed entry price without worrying about slippage caused by spread widening. However, improper risk management on these accounts can expose brokers to arbitrage abuse, leading to unfair trading profits for some clients.

The Change Spread by Period trigger helps brokers detect and prevent arbitrage strategies that take advantage of fixed spread pricing under low liquidity conditions.

1. Arbitrage Opportunities in Fixed Spread Accounts

Most brokers offer account types with a fixed spread, ensuring a predictable cost of trading. However, during low liquidity periods (e.g., at night), spreads on floating instruments widen significantly, while the fixed spread remains unchanged. This creates a highly profitable environment for arbitrage traders who exploit these differences using automated tools.

🔹 How Arbitrageurs Operate:

-

They compare real market quotes with the broker’s fixed spread prices.

-

When the ask price moves away from standard values, the bid price follows, creating a temporary price spike (hairpin).

-

Using automated advisors, they quickly enter and exit trades, capturing a risk-free profit before the price spike corrects itself.

-

On floating spread symbols, these spikes do not occur, as the bid price stays in place while the ask price moves, creating a wide spread that prevents arbitrage.

2. Automated Spread Widening to Neutralize Arbitrage

A proven way to counter this exploit is to adjust the fixed spread dynamically during low-liquidity hours. Based on personal experience:

-

Optimal time window: 23:00 – 06:00, when liquidity is lowest.

-

Spread expansion factor:

- Major instruments: Increase by 2x (e.g., from 3 to 6 pips).

- Cross rates: Increase by up to 5x (e.g., from 8 to 12 pips).

✅ Why This Works:

- Normal traders do not trade actively during low liquidity hours, so their strategy remains unaffected.

- Arbitrage traders lose their edge, as the expanded fixed spread eliminates the price distortions they rely on.

- Brokers maintain fair trading conditions while protecting themselves from unnecessary losses.

Conclusion

Without proper controls, fixed spread accounts can become a major liability for brokers due to arbitrage abuse. By implementing automated spread widening during low liquidity hours, brokers can eliminate these unfair advantages while ensuring a balanced and sustainable trading environment for all clients.