Achieved Profit

General Information

The Achieved Profit trigger detects the percentage of profit a trader achieves while considering all deposit and withdrawal operations.

📌 The Achieved Profit trigger allows you to create multiple rules for the same account or account group. If several rules are triggered simultaneously, the rule with the highest Threshold value takes priority.

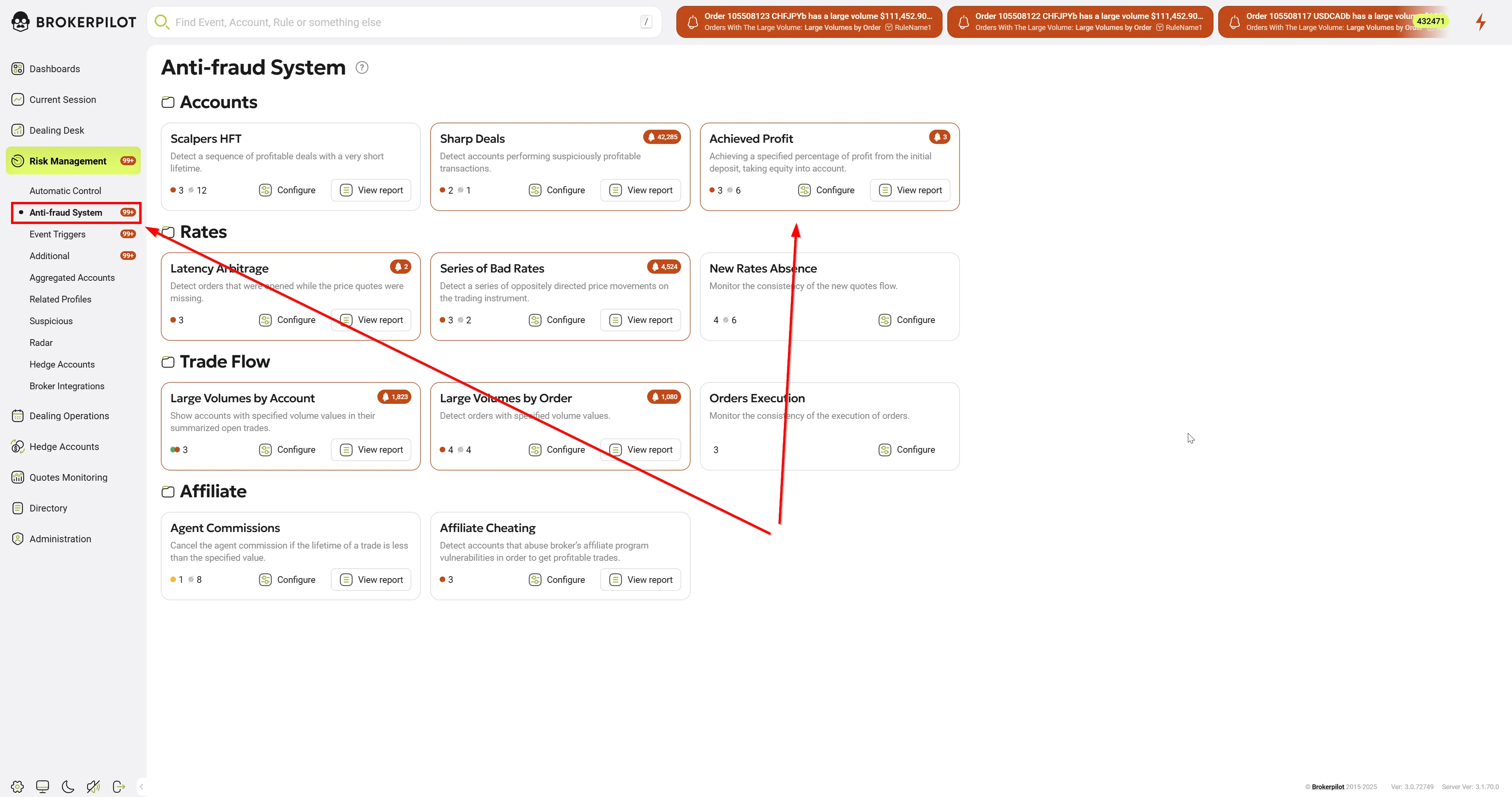

Menu Navigation

You can find the Achieved Profit trigger under:

📌 Risk Management → Anti-Fraud System

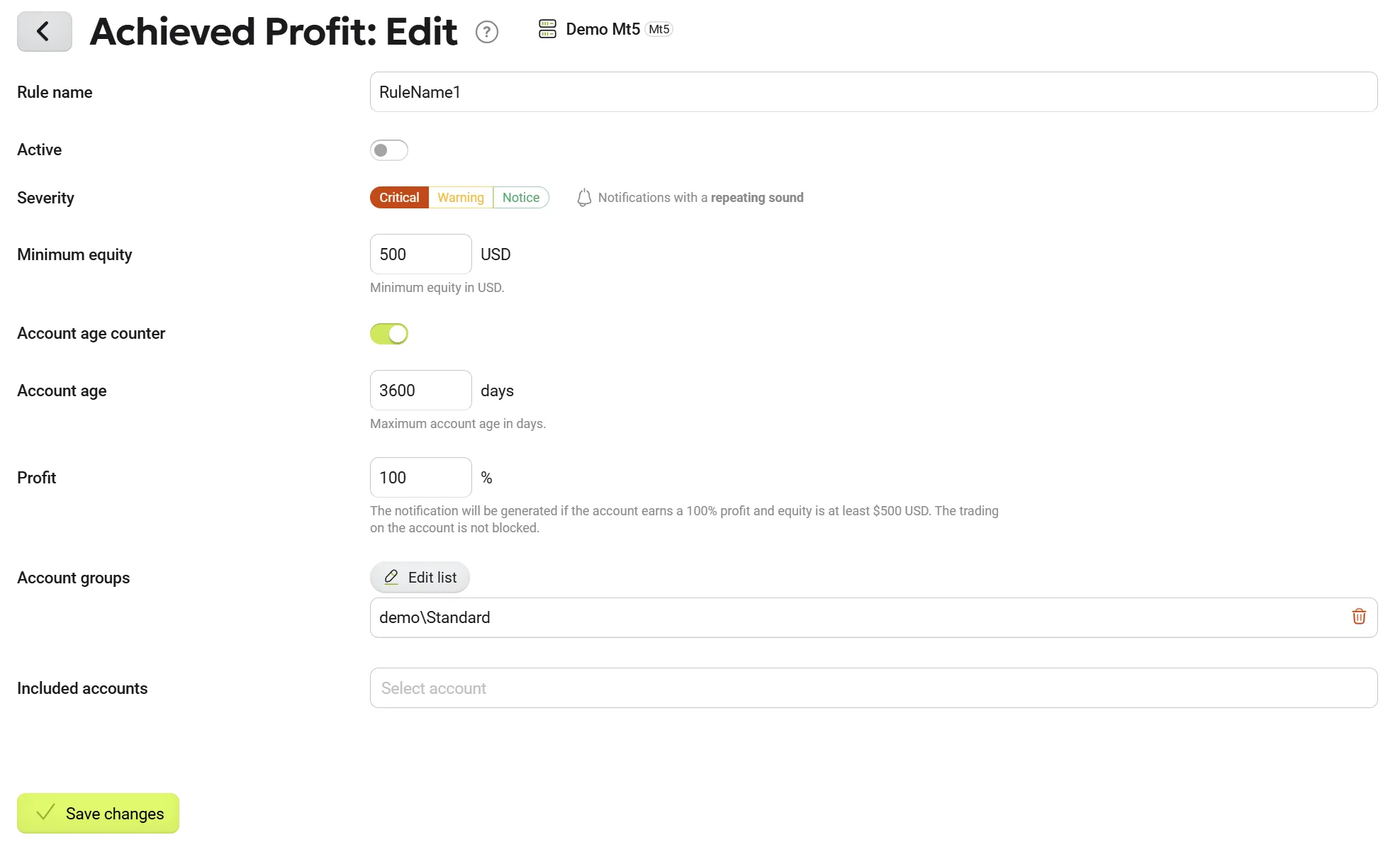

Edit Settings ⚙️

Available Settings

| Parameter Name | Description |

|---|---|

| Rule Name | Assign a specific name to the rule. |

| Minimum Equity, USD | Set the minimum account equity in USD required for the trigger to activate. |

| Profit, % | Define the profit percentage threshold (e.g., 100% means the account has doubled). |

| Account Age Counter | Set the maximum number of days the account must exist. |

| Account Groups | Select account groups to monitor. |

| Accounts | Enter specific account numbers to monitor. |

Permissions

| MT4 | MT5 |

|---|---|

| No specific permissions are required. | No specific permissions are required. |

Trigger Logic 🔍

The Achieved Profit trigger calculates profit based on the trader’s own funds. It examines all deposit and withdrawal transactions to determine the account's profit percentage.

How It Works

1️⃣ Establishing the "Base Point"

- The trigger analyzes all deposit and withdrawal transactions.

- It sets a Base Point for profit calculation.

- Withdrawals of trade profits do NOT lower the Base Point, but withdrawals of personal funds do.

2️⃣ Trigger Activation

- If the profit percentage threshold is exceeded, the trigger generates a notification.

- If the account equity falls below the threshold, the notification remains until handled.

3️⃣ Notification Handling & Updates

- If the trigger settings are modified, all previous notifications that no longer match the new criteria are automatically deleted.

User Case: How the Trigger Works

Brokers frequently ask where the percentages shown in alerts come from and what exact logic causes the trigger to fire. This case study explains the calculation logic step-by-step and demonstrates that the system behavior is correct.

Data from the Notification

From the alert text, we have the following values at the moment of the trigger:

| Parameter | Value |

|---|---|

| Equity at the moment of the alert | $2,110.09 |

| Recorded Profit | $2,047.47 |

Step 1: Profit Calculation Relative to a Base Level

The system does not calculate profit based simply on total deposits minus withdrawals. Instead, profit is always calculated relative to a dynamically determined Base Level.

Base Level: Represents the effective starting capital from which account growth is measured.

The Base Level can be derived directly from the notification values using the following formula:

$$Base\ Level = Equity - Profit$$

Calculation: $2,110.09 - 2,047.47 = 62.62$

The calculated Base Level is $62.62.

Step 2: How the Base Level is Determined

Because this was the first notification for this account, the system determined the Base Level by analyzing the entire financial history of the account.

The algorithm processes the full sequence of:

- Deposits & Withdrawals

- Balance changes

- Equity changes over time

Why not use simple Net Deposits?

A simple calculation (total deposits - total withdrawals) does not reliably reflect real account exposure, especially if the account experienced drawdowns, partial withdrawals, or multiple funding cycles. Instead, the algorithm identifies a point of maximum net invested capital or a relevant lower bound.

Step 3: Result of the Historical Analysis

After analyzing 24 balance operations and the full equity dynamics, the algorithm determined:

- Effective Starting Capital: $62.62

This value was fixed as the Base Level (the zero reference point) for the trigger.

Step 4: Trigger Activation

Timeline

- History: Account 403815 had multiple deposits and withdrawals.

- Baseline: The system established $62.62 as the Base Level.

- Growth: On September 11, following trading activity and a final deposit of $1,515, the Equity increased to $2,110.09.

Trigger Calculation

The system performed the final verification:

- Absolute Profit: 2,110.09 - 62.62 = 2,047.47

- Profit Percentage: (2,047.47 / 62.62) × 100 ≈ 3,269%

- Threshold Check: The result was compared against configured thresholds, and the alert was generated once the 3,269% growth was detected.

Summary

- Dynamic Base Level: Alert percentages are relative to a calculated starting point, not just total deposits.

- Accurate Analysis: The Base Level is derived from the full account history.

- Conclusion: In this case, the 3,269% growth correctly triggered the alert based on the effective starting capital of $62.62.

The investigation confirms that the trigger logic functioned as designed.

🎯 Key Takeaways:

✅ Monitors profit percentage based on real trader funds

✅ Ignores profit withdrawals but tracks personal fund withdrawals

✅ Alerts when profit exceeds a defined threshold

✅ Supports customizable account selection & age tracking