Radar

General Information

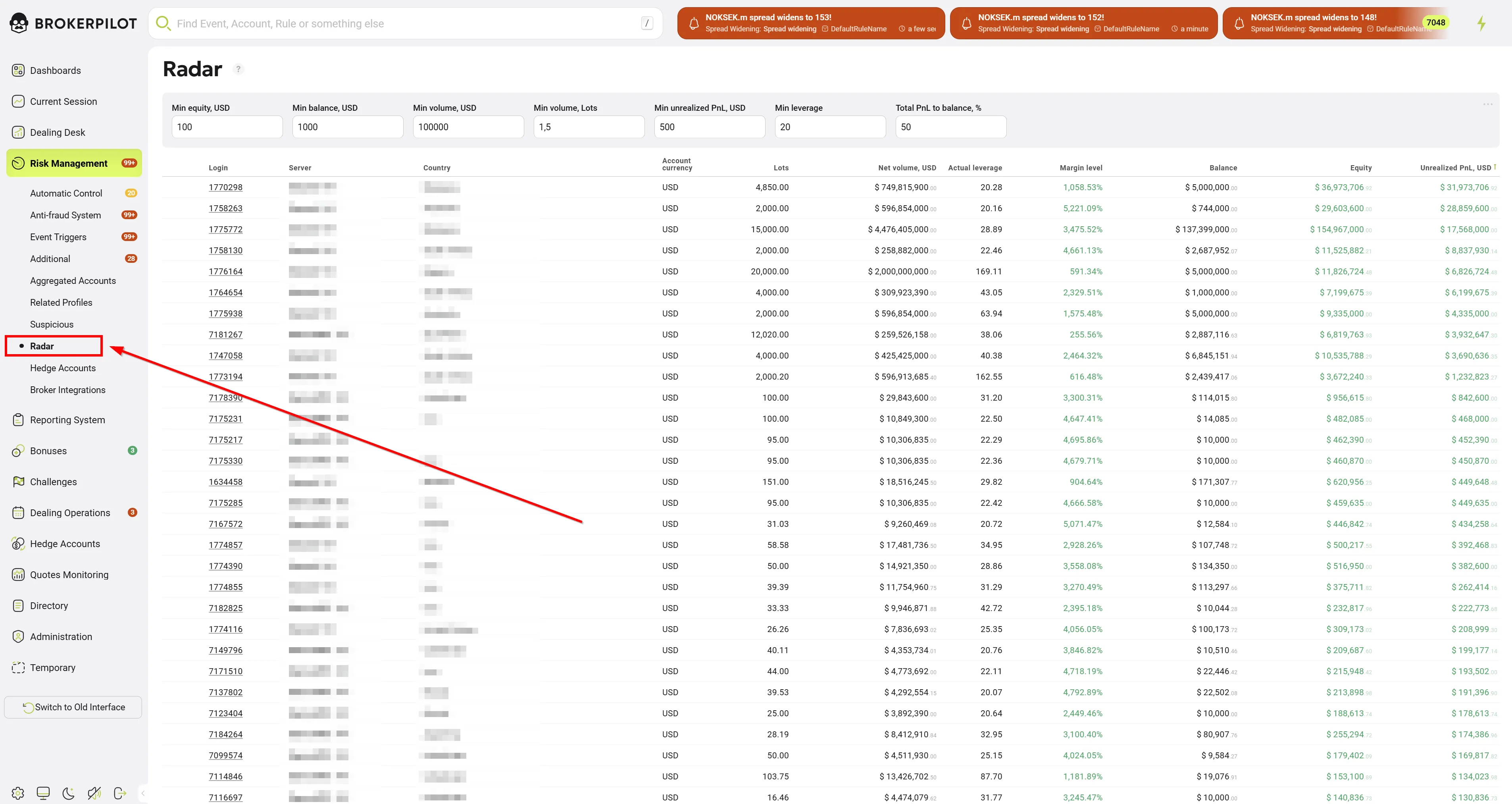

The Radar section provides brokers with a real-time overview of the most profitable traders within their system. By using customizable filters, brokers can identify high-performing traders based on specific financial and trading parameters.

This feature is particularly useful for:

- Monitoring large or aggressive traders who may pose risks to the brokerage.

- Identifying trading strategies that consistently generate significant profits.

- Detecting potential arbitrage or suspicious activity by setting alerts for unusually high gains.

- Assessing leverage usage to prevent excessive risk-taking.

By setting minimum thresholds for key metrics such as equity, balance, trading volume, leverage, and unrealized profit, brokers can filter and track specific traders that meet their criteria. The Radar ensures that brokers have immediate visibility into high-impact trading activity, allowing them to respond proactively to potential risks or opportunities.

Menu Navigation

📌 You can find the Radar page in Risk Management section.

Radar Filters

Brokers can fine-tune the Radar by setting the following minimum values:

| Parameter Name | Description |

|---|---|

| Min Equity, USD | Sets a minimum equity threshold. |

| Min Balance, USD | Sets a minimum balance threshold. |

| Min Volume, USD | Sets a minimum trading volume threshold in USD. |

| Min Volume, Lots | Sets a minimum trading volume threshold in Lots. |

| Min Unrealized Profit, USD | Sets a minimum unrealized profit threshold. |

| Min Leverage | Sets a minimum leverage threshold. |

| Total PnL to Balance, % | Sets a minimum percentage of total profit to balance. |

How It Works

- Adjust filters – Set the minimum values for the traders you want to monitor.

- View filtered traders – The system displays traders who meet the criteria.

- Monitor in real time – Get insights into profitable accounts and their trading activity.