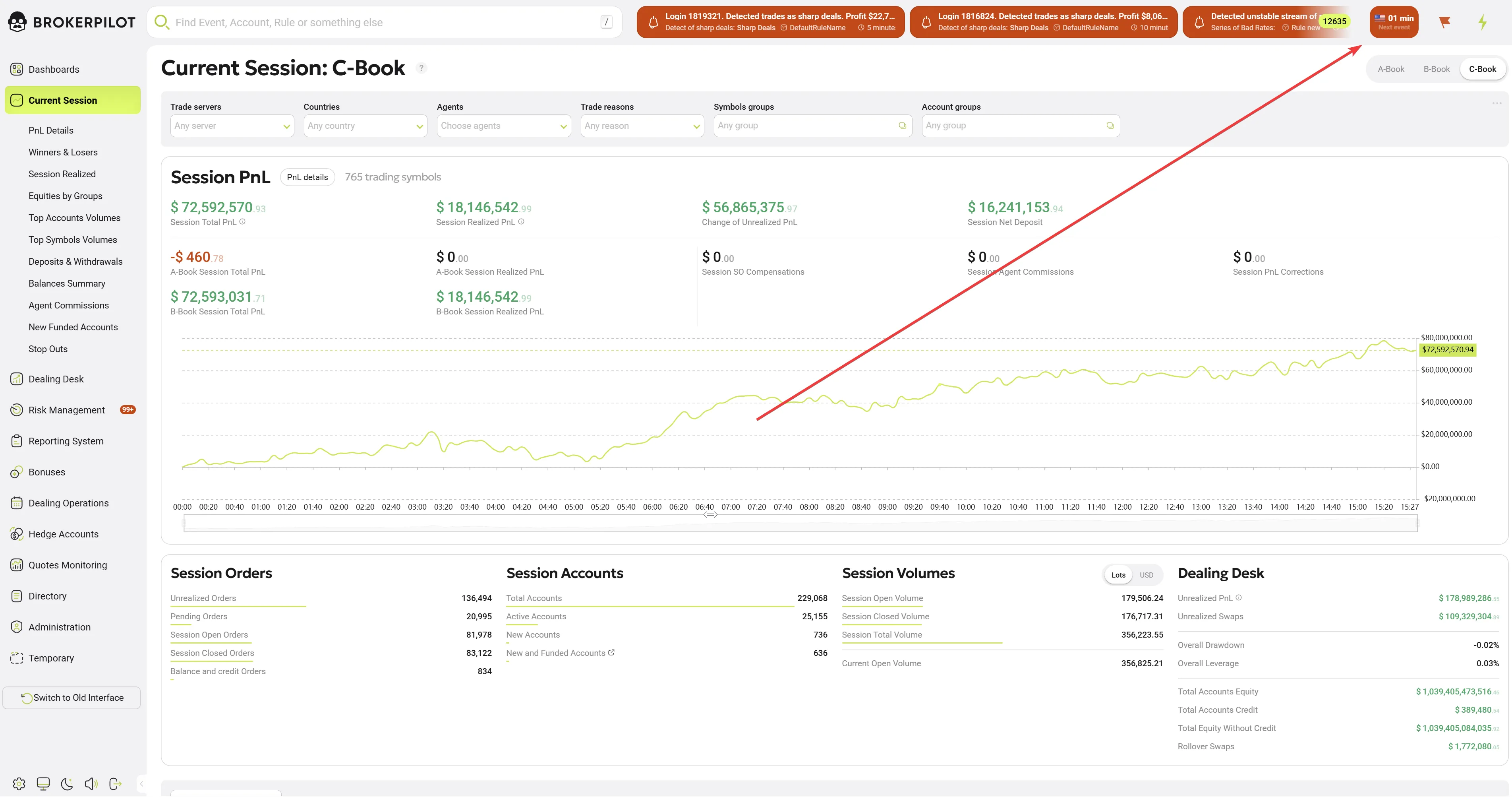

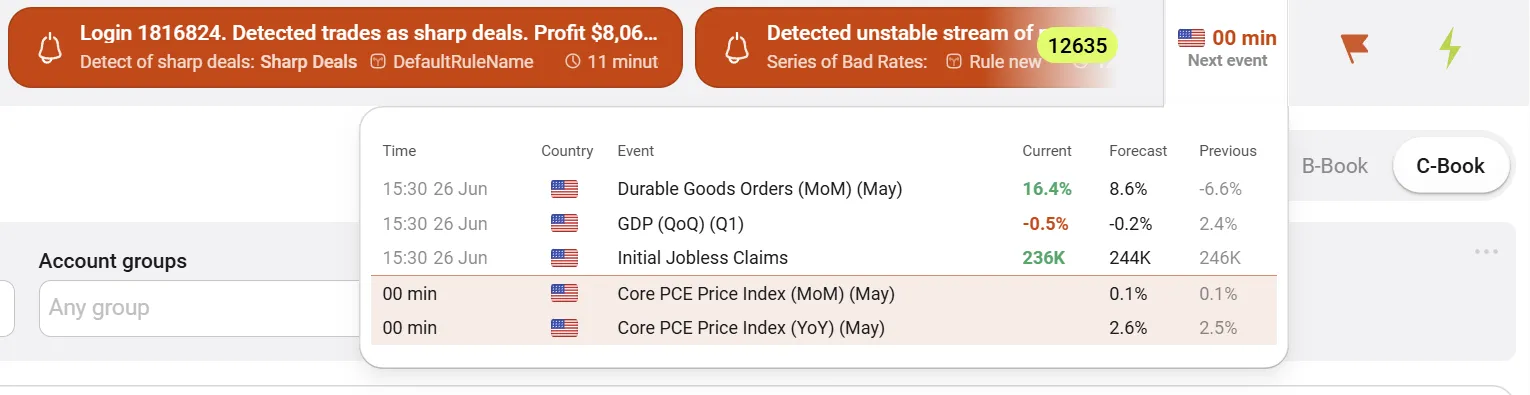

Economic Calendar

Economic Calendar Overview

The Economic Calendar displays key upcoming macroeconomic events that may influence market activity. Each entry provides the following details:

- Time & Date of the event

- Country associated with the announcement

- Event name (e.g., Nonfarm Employment Change, Interest Rate Decision, PMI)

- Current, Forecast, and Previous values (if available)

Events are listed in chronological order and updated in real time.

Visual Highlights

- Events happening within the next hour are highlighted with a red background to signal urgency.

- A countdown timer shows how many minutes remain until the next scheduled event.

- Events are fetched from Investing.com Economic Calendar.

Brokers need to see upcoming events in the economic calendar for several important reasons:

🔔 1. Risk Management

Upcoming economic events (like interest rate decisions, CPI reports, or NFP releases) can cause significant market volatility. Brokers need to:

- Anticipate sharp price movements that may affect client positions.

- Adjust risk parameters, such as margin requirements, before high-impact events.

- Prevent overexposure or liquidity issues during volatile periods.

📊 2. Liquidity Planning

Events that affect market sentiment can lead to spreads widening, low liquidity, or slippage. Brokers use the calendar to:

- Communicate with liquidity providers in advance.

- Adjust execution strategies.

- Plan for off-book coverage or hedging needs.

🧠 3. Client Support & Education

Economic calendars help brokers:

- Proactively inform traders about high-impact events.

- Provide commentary or analysis to help clients make informed decisions.

- Align client expectations with market conditions.

⚙️ 4. Internal Operations & System Load

High-impact news often increases trading volume. Brokers need time to:

- Ensure infrastructure scaling (especially during spikes in order traffic).

- Test or adjust risk engines and trading system performance.

- Monitor for potential system overloads or latency.

📅 5. Strategic Planning

Brokers use economic calendars to:

- Schedule maintenance windows away from high-volatility periods.

- Time promotions, communications, or feature releases during quieter periods.

- Align internal operations (e.g., Dealing Desk shifts) with known volatility cycles.

✅ Summary

The economic calendar is not just a trader’s tool — it's a core operational resource for brokers. It supports risk control, execution quality, client engagement, and overall business stability.